Renters Insurance in and around Peoria

Peoria renters, State Farm has insurance for you, too

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

There’s No Place Like Home

Being a renter doesn't mean you are 100% carefree. You want to make sure what you own is protected in the event of some unexpected catastrophe or trouble. And you also need liability protection for friends or visitors who might become injured on your property. State Farm Agent Danielle Biondo is ready to help you handle the unexpected with dependable coverage for your renters insurance needs. Such personalized service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If mishaps occur, Danielle Biondo can help you submit your claim. Keep your home in a rental-sweet-rental state with State Farm!

Peoria renters, State Farm has insurance for you, too

Coverage for what's yours, in your rented home

Protect Your Home Sweet Rental Home

No one knows what tomorrow will bring. That’s why it makes good sense to plan for the unexpected with a State Farm renters policy. Renters insurance protects your precious belongings with coverage. If you experience a theft or a burglary, some of your most treasured items could have damage. If you don't have enough coverage, you may struggle to replace the things you lost. It's scary to think that in one moment, you could lose it all. Despite all that could go wrong, State Farm Agent Danielle Biondo is ready to help.Danielle Biondo can help offer options for the level of coverage you have in mind. You can even include protection for valuables beyond the walls of your home. For example, if your bicycle is stolen from work, a pipe suddenly bursts in the unit above you and damages your furniture or your personal property is damaged by a fire, Agent Danielle Biondo can be there to help you submit your claim and help your life go right again.

It's always a good idea to make sure you're prepared. Visit State Farm agent Danielle Biondo for help understanding savings options for your rented space.

Have More Questions About Renters Insurance?

Call Danielle at (623) 259-2990 or visit our FAQ page.

Simple Insights®

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Is renters insurance required?

Is renters insurance required?

Renters insurance protects more than your belongings in the event of a loss. Learn about what renters insurance covers and how it can help you.

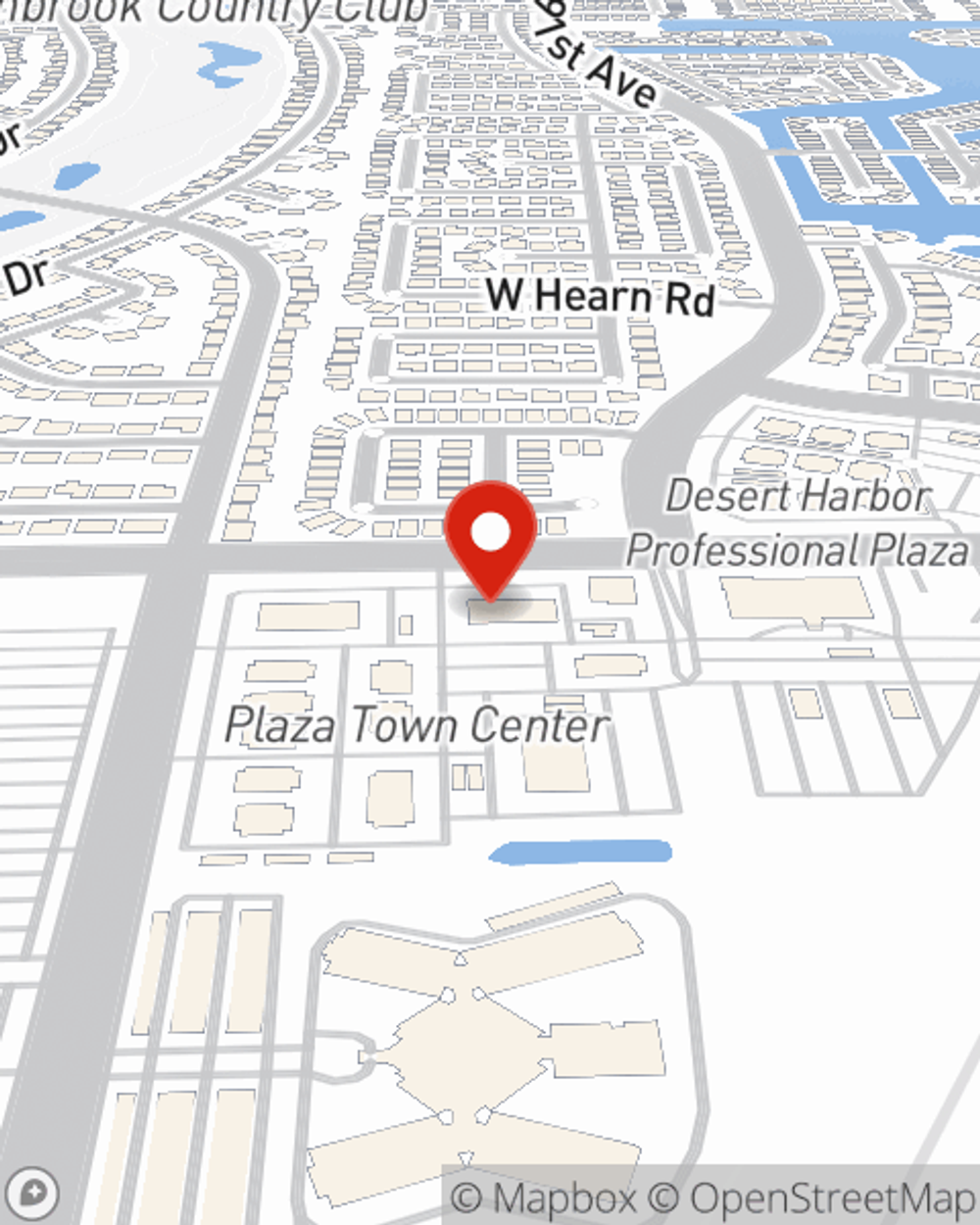

Danielle Biondo

State Farm® Insurance AgentSimple Insights®

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Is renters insurance required?

Is renters insurance required?

Renters insurance protects more than your belongings in the event of a loss. Learn about what renters insurance covers and how it can help you.